The title of “instant payment” is self explanatory. However, when we send and receive instant payments, we don’t consider the steps, processes, and institutions involved in the transaction. So what really happens in an instant payment?

1. Initiation

When the payment is initiated, the process of a SEPA instant payment begins. Normally, it starts with the user’s online banking or mobile app, but it can also be started with an API like Devengo’s.

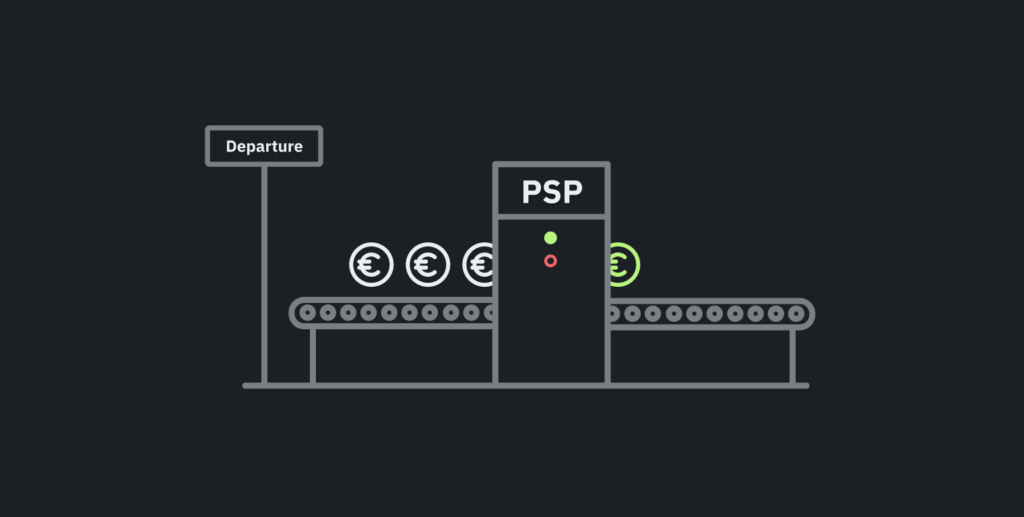

Once a user clicks “send”, the SEPA instant payment is initiated. From there, the money is blocked within the account by the entity initiating the payment. This entity is called a Payment Service Processor, or PSP. The money will only become available again if the payment fails. The PSP blocks this amount in its books, but the reality is that this money is truly blocked in the European Central Bank (ECB), where the PSP maintains an account with enough money to handle its operations.

2. Authorization

From here the PSP needs to complete a series of Anti Money Laundering (AML) and velocity checks in order to validate that the transaction isn’t suspicious. This reduces fraud and avoids money laundering. Some of these checks might look like: Is the receiver of the payment valid? Is there something to be worried about with this payment? (amount, recurrency, etc.)

Once those checks are passed, the PSP is ready to put the transaction onto the next step, and the money proceeds to its destination.

3. Transmission

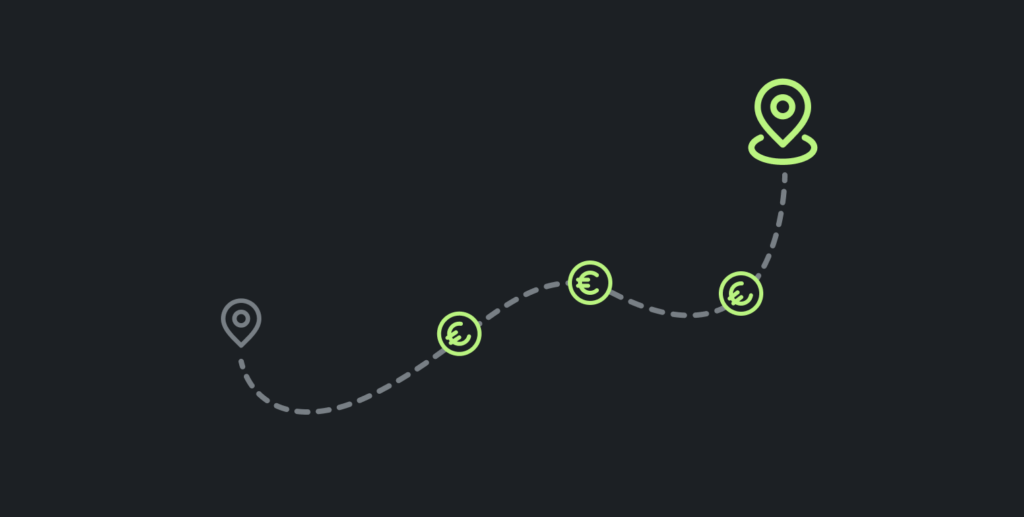

Next, The PSP sends the payment request to the Account Clearing House (ACH) it is connected to. Which in turn, connects to the next clearing house in the chain until it arrives at its destination PSP.

There are two networks for instant payments in SEPA. One operated by the European Central Bank (ECB) called TIPS, and a second one by the European Banking Association (EBA) called RT1. They have a few differences, but the process is the same.

So how does the transmission of a SEPA instant payment work?

The steps are as follows:

- A SEPA Instant Payment is sent from a customer of a PSP (A) connected in Spain to another customer whose PSP (B) is connected in Germany.

- PSP A is going to send the request to the Spanish clearing house (Iberpay), which in turn will then send the instruction to the EBA clearing house or ECB depending on the network chosen.

- The network will then pass the instruction to the German clearing house (operated by the Bundesbank), who will pass it to the destination PSP B.

4. Acceptance

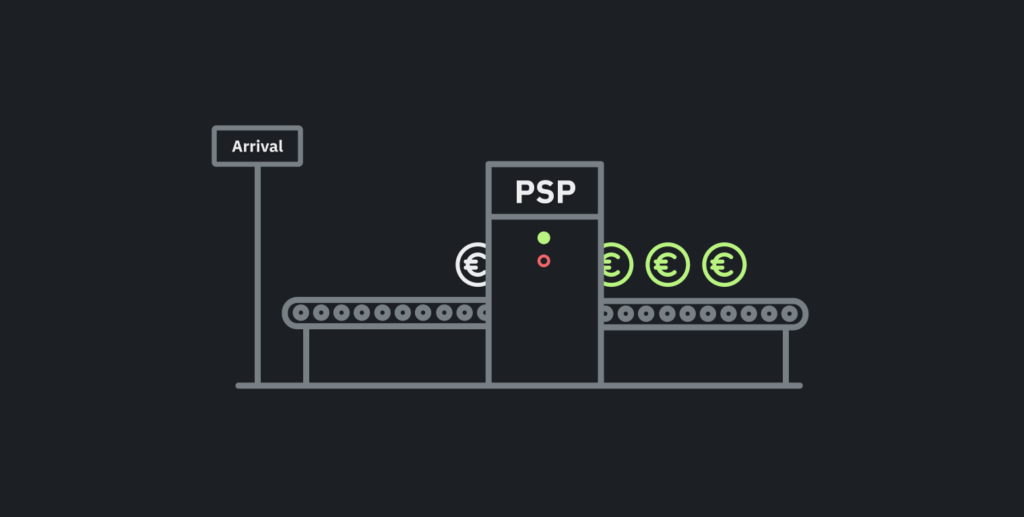

When the destination PSP receives the instruction, it performs new checks. It needs to check that the account is valid, open, and that there’s no regulation or law enforcement that prevents the deposit of funds. Occasionally, it needs to verify if the account belongs to the person referred in the payment instruction.

If everything is ok, this PSP will respond with an OK message, and will pass this message on through the chain.

5. Receipt

The response of the destination bank is the same process, just in the opposite direction. Once the origin PSP receives the response, it then sends feedback to the payer of the result of the operation.

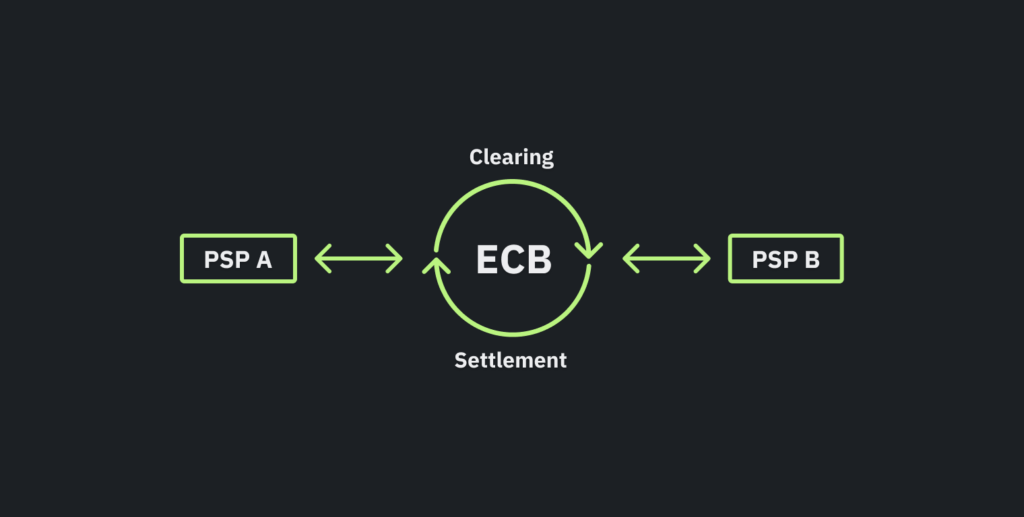

But there’s one critical part to this process: Once the response arrives, the operator of the network (EBA or ECB), will pass on the result, but additionally it will settle the operation in the ECB and notify the PSPs that they can then debit the accounts from the payer and payee.

Remember when we said that the money was truly blocked in an account that the origin PSP has with the ECB? The destination PSP also has an account with the ECB, and the process of settlement is to move the money from one PSP account to the other.

Then, the ECB notifies both PSPs to update their books, or in other words, to debit the payer’s bank account and to credit payee’s. This ensures that the money flows without any problems.

Rejection

It seems perfect so far, right? And for the most part, it is, but there can be a couple problems:

- The destination PSP rejects the request. As we have shown earlier, destination bank accounts can be closed, blocked, or its holder can be sanctioned, etc.

- There can be connection problems caused by system failures or system updates. They are handled by the network notifying the other participants that there has been a problem.

In all cases, the operation won’t be settled and the money will be liberated from PSP’s account in the ECB and in the payer’s account in the PSP.

Sending an instant payment is a process that feels easy: I click send and the money is there instantaneously. But as we have seen, there are a lot of parts and systems involved to make this happen, and sometimes it fails.

So if you integrate instant payments into your company’s processes, be sure you work with a PSP that helps you handle it when it fails. Like Devengo does, of course.