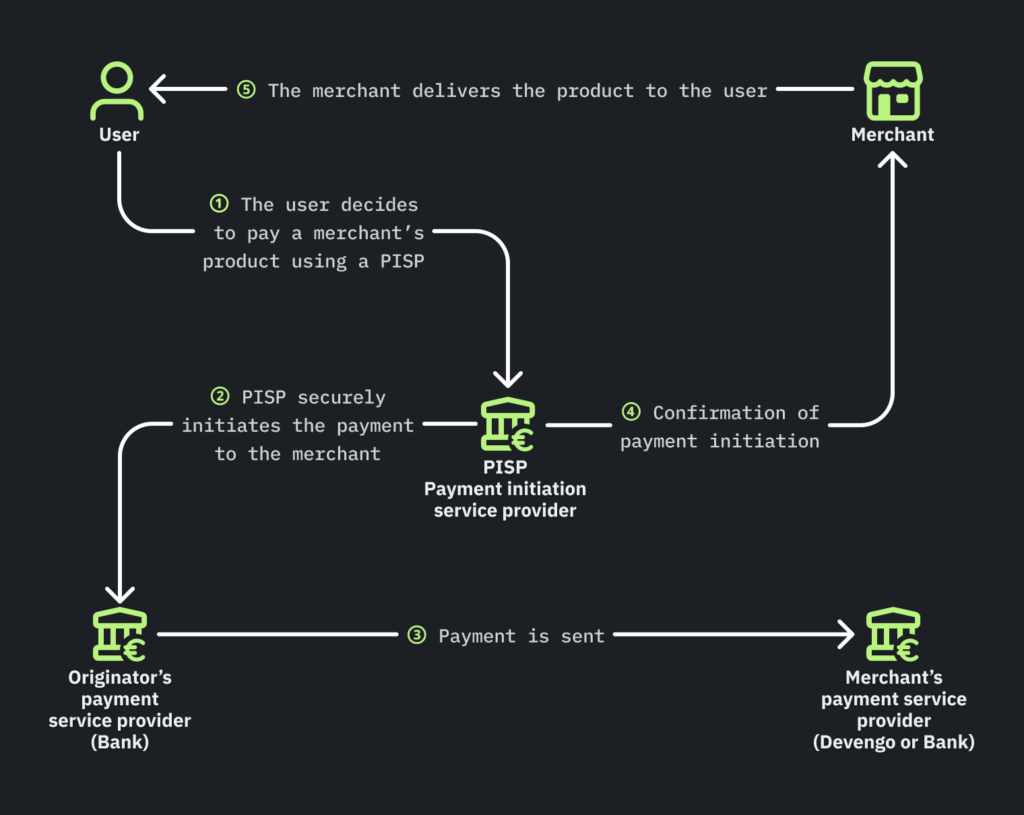

PISPs enable customers to initiate electronic payments directly from their bank accounts to pay for goods or services, transfer funds, or make other financial transactions. These payment initiation services are typically conducted over the internet or through mobile applications.

Why do we need PISPs?

When talking about internet payments we tend to think that cards are everywhere but that’s far from true. That’s of course not true for businesses and corporations but also for end customers that’s not always true. The amount could be too large for card limits, or just the conditions from the card networks don’t match our requirements (e.g. charbacks or fees). So it makes sense to look for alternatives and account-to-account payments is one of them.

But account-to-account payments have a big problem: they normally break the online flow.

Your customer places an order, you send them the instructions for making the wire transfer… and wait.

Check your bank statements and wait

You remind your customer and wait…

Until finally you find the statement in your bank account or desist, canceling the order.

PISPs try to fix this. In a similar way to how cards work, you send the payment instructions, they redirect your customer to their online banking and they finalize the transaction there. Once they have finished the process, you receive a notification and can mark the order as paid. Sounds good, right?

Not perfect, but good enough and here you have some of the common usages of PISPs:

- Online Shopping: PISPs facilitate online shopping initiating payments directly from their bank accounts when making purchases, reducing the need for credit card information or allowing larger amounts.

- B2B Payments: Companies selling products or services to other businesses can use PISPs to streamline the payment of invoices, for example in the travel industry.

- Subscription Services: PISPs are starting to be used for subscription-based services since they can handle recurring payments too.

A bit of history

PISPs originated as a response to the growing need for more efficient and secure online payment methods, especially in environments where a credit or debit card was insufficient or inefficient. They gained prominence in the late 2000s as the digital economy expanded.

First they were built as _hacks_ to the banking system, with Sofort and Trustly as the main examples, but the European Union’s PSD2 (Payment Services Directive 2), enacted in 2015, laid the current regulatory foundation for PISPs. PSD2 mandated the opening of banks’ APIs to third-party providers, enabling the initiation of payments directly from bank accounts.

The PSD2 regulation includes:

- The process to obtain an authorization of national regulatory authorities to operate as a PISP

- The Authentication mechanism to ensure the security of transactions

- The data protection regulations to safeguard customer data

- The liability and security of the processes of the PISP against fraudulent and unauthorized transactions.

Shortcomings of PISPs

Although you may only see advantages on using PISPs, there are a few shortcomings:

- Consumer Awareness: Many consumers are not fully aware of PISPs and their benefits, which can limit their adoption. This also causes some security concerns.

- Limited Global Reach: PISPs, especially European-based providers, may have limitations in international markets, which can hinder cross-border transactions.

- Dependency on Banks: PISPs heavily rely on the cooperation of traditional banks and their API availability, which can lead to operational challenges, especially when talking about B2B payments which require more complex authorization scenarios.

- A bit of operational burden: each payment originated by a PISPs translates into a statement in your bank account. And although they always try their best, the information you received to settle your payments might not always be the one you expected.

Devengo and PISPs

Is Devengo a PISP? No. Devengo is an API to help businesses send instant payments (money goes from company to customer) while a PISP, as we have seen, is a service to help customers pay the business (money flies from customer to company).

Similar, but different. But, the fact is that we are complementary. Devengo collaborates with PISPs helping them to provide a better service. For example:

- A PISP knows when the customer has approved the payment in their online banking, but has no confirmation that the money has arrived or been executed. Devengo can provide the business a bank account and help the PISP with reconciliation.

- Wire transfers don’t have a refund operation. That means, if the customer returns part of the order, the company needs to do a wire transfer manually. Using Devengo’s API they can refund an order from PISPs control panel.

- As we have said, each payment creates a line in the bank statement of the company, which can be difficult to handle. Using a bank account from Devengo, PISP customers can have a collection account and receive the result of their sales daily in a single movement, with full information for reconciliation in the PISP.

Final thoughts

Are you using a PISP? Do you feel any of the pains related above? Put us in contact with your PISP and we will make your life easier. Or are you looking for a PISP? Contact us and we will help you find the one that suits you best.