The main mission of Devengo is to allow our customers to move their money through our API as quickly as possible. In most cases, the journey of money between the source and destination accounts is instantaneous, but there may be occasional delays.

These delays can be due to the nature of the payment itself, which may not be instant if the destination bank does not accept instant transfers. They may also be caused by AML (Anti Money Laundering) processes or be stopped at any of the steps through which the payment passes, triggering our Smart Retry System.

But at Devengo, we were curious: is it possible to know in advance how long a payment will take, and if delayed, have updated information on the delay time? The answer is yes, and for that, we have the Estimated Time of Arrival (ETA).

What is Estimated Time of Arrival?

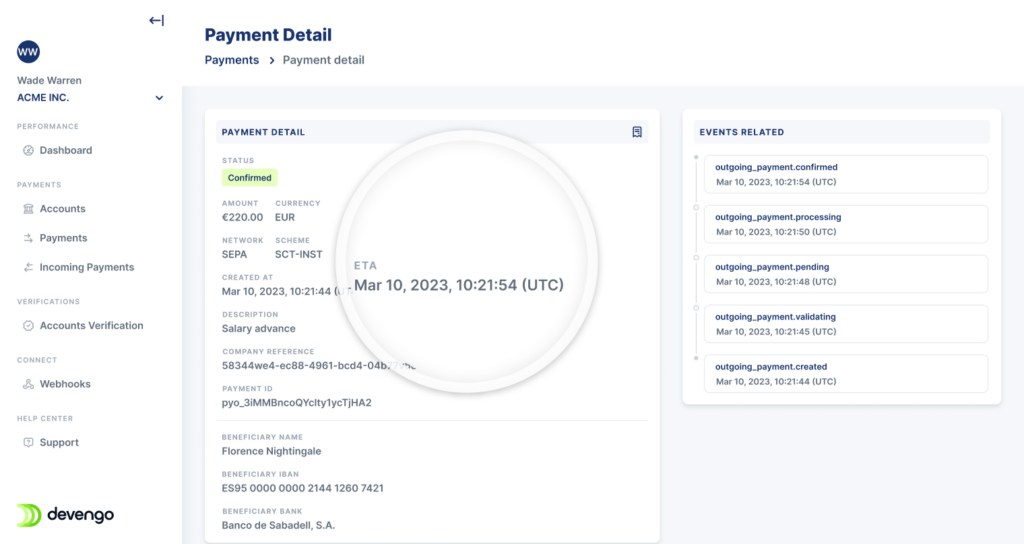

Money moving quickly is a crucial part of our operations, but it’s not the only reason why our customers choose us. We understand that having access to as much information as possible about the status of their payments is critical for them. The moment a payment is created, Devengo provides an Estimated Time of Arrival (ETA) for that payment. This information can be accessed through the API response at the time of payment creation, through the Webhooks sent during changes in payment status, and through the payment details in our Control Panel.

From the moment a payment is created in our API, the response to the call to the payment creation endpoint includes an estimated time in the following format: “eta”: “0000-00-00T00:00:00Z.” Our control panel displays this estimated time on the payment details screen as well.

Devengo provides an ETA for both instant and traditional payments. In 99.734% of instant payments, the ETA will be 10 seconds or less. For regular payments, which represent the remaining percentage of transactions, the estimated time of arrival has a broader range, spanning from 24 to 72 hours. This difference is due to the fact that non-instant operations, specifically those processed as SCT-REGULAR, are not conducted 24/7. The processing of regular payments is tied to batches of transactions sent to the clearinghouse (settlement) at specific hours, as well as the receiving times of destination banks that do not operate on holidays. If you want to learn more about the differences between regular (traditional) payments and instant payments, our colleagues Carlos and Nacho wrote a post on the subject.

How does ETA benefit our clients?

The primary benefit our clients gain from having an ETA at the moment of payment creation is the ability to instantly communicate to their customers when they will receive the money. Having an Estimated Time of Arrival for the money gives our clients the opportunity to keep their customers informed, thereby increasing confidence that the process is underway and monitored, simultaneously reducing the number of support requests.

An illustration of this is the utilization of the ETA by our clients in the salary advance industry. In their case, the ETA serves as a potential trigger for notifying employees requesting an advance, providing precise information about the arrival time of their money. Similarly, clients such as Reveni in the returns sector or Barkibu in the insurtech sector can use the ETA provided by Devengo. Their users know in real-time when they can expect the money from a return or a claim, respectively.

An Always Updated ETA

Until now, our ETA was static. It was calculated at the creation of the payment and remained unchanged even if there were delays due to AML processes, it entered our Smart Retry System, or there was a scheduled delay. This situation could cause certain estimated times to be displayed as past times.

If only 0.99% of payments in November have been non-instantaneous, and Devengo has a monthly success rate of 99.734%, why bother displaying and updating the ETA? Because at Devengo, we know that this minority of operations is the cause of the majority of support team complaints. By proactively providing detailed and as precise information as possible, we ensure that our clients have the necessary information to offer to their customers or users.

Now, with our new dynamic ETA, our clients can have much more accurate expectations of when the payment will reach its destination. Let’s examine in detail the cases in which the ETA can be updated.

Smart Retry System:

Sometimes, due to issues with the banking system, a payment may enter our Smart Retry System to be tried later. In this case, the ETA will be updated based on the specific error type returned by the banking system. The majority of these cases will be resolved within an extra estimated time of 30 minutes.

Scheduled Maintenance:

Rarely, it is possible that we may need to halt the delivery of payments to the banking infrastructure, as it may be undergoing maintenance or experiencing unexpected downtime. In such cases, all affected payments will transition to a “delayed” state. In this scenario, the new dynamic ETA will update its time to add 6 hours, which is an estimate based on historical bank downtimes.

AML Processes:

When a payment undergoes a review process to ensure that it is not susceptible to money laundering operations, the payment status changes to “blocked.” At that moment, the initial ETA of the payment is updated by adding the time required for an AML process, which is 3 business days. Due to additional information about the beneficiary that must be requested from the client, this case needs more time than others.

When the payment is confirmed:

This is a special case that affects a very small percentage of some payments that are impossible to deliver instantly, even if our client has requested it, and they end up being delivered through regular processing. These payments, initially processed under the SCT-INST scheme, ultimately get processed under the SCT-REGULAR scheme. This requires the initial 10-second ETA to be updated to a time consistent with a non-instant payment.

Conclusions

At Devengo, we persist in our pursuit of continuous improvement in detail so that we understand their impact on operations and support for our clients. We recognize that efficiency, security, and speed are only achievable when even the smallest details are taken into account. That’s why, at Devengo, we continue to strive to provide the best B2B payment API.