SEPA, the standard payment instrument is born

Transferring money to someone living in another European country is remarkably easy today with a payment account. It has become so easy that we sometimes forget that it wasn’t always this way. This is all thanks to the Single Euro Payments Area or SEPA.

Single Euro Payments Area (SEPA) is a payment integration initiative of the European Union. Since 2014 people and companies have been able to send and receive payments in euros (€) between two cross-border bank accounts, in the eurozone. So, sending Euros from Spain to a bank account in Germany is pretty much as easy as sending it to another account right here in Spain. As if you were sending money down the block, but a bit farther away!

The problem

Before SEPA came along, making payments in Europe was a bit of a mess. Each country had its own set of rules for sending money or setting up direct debits, which made everything difficult to coordinate and was inefficient. For example, in Spain, there were products considered niche that only worked within the national territory: different forms of direct debits (like Norma 32 and Norma 58). The same thing happened in the rest of the EU countries, so it was complex to carry out inter-country operations.

The solution

The aim of SEPA is to improve the efficiency of cross-border payments and turn the previously fragmented national markets for euro payments into a single domestic one. SEPA resolved the problem and removed customized local instruments that could be replaced with new standards.

Some of the advantages of a single euro payment area include

- Services for payments in a single market

- Handling of payments simplified

- Common standards reduce processing costs

- By increasing competition within the zone, bank charges were reduced

- Reduced processing times

A Collaborative Process

The European Commission, as the executive branch of the European Union, established the legal foundation of SEPA through the Payment Services Directive (PSD).

The commercial and technical frameworks for payment instruments were developed by the European Payments Council, an organization that represents payment service providers (PSPs) in the European Union (EU) and is responsible for defining and maintaining the SEPA payment schemes, rulebooks, and technical standards.

Another important stakeholder of the SEPA initiative is EBA Clearing. Its initial mission was to create and operate the clearing and settlement system for high-value euro transactions.

A Look Into the SEPA timeline:

-

-

2007The first Payment Services Directive (PSD1) was adopted in 2007 by the EC. This legislation provides the legal foundation for an EU single market for payments

-

2008The legal basis for the establishment of the SEPA was in 2008. Launch of SEPA Credit Transfer and SEPA Direct Debit schemes in 2008 by EPC

-

20142014 marked the deadline for migration to SEPA standards for euro payments within the SEPA area. SEPA was fully implemented for credit and debit payments

-

2017SEPA Instant Credit Transfer (SCT Inst) was introduced, allowing for almost real-time euro transfers across SEPA countries

-

2019The EC introduced rules to stop banks from charging extra fees for cross-border transactions within the EU, ensuring equal costs for transferring euros

-

2020The SEPA Request-to-Pay scheme is introduced. This is a fundamental scheme for the integration of pull payments in Europe

-

2021SEPA payments are 94% of all credit transfers and 98% of direct debits in the eurozone. But only 15% of payments are instantly transferred, there’s room to improve!

-

Who is a part of SEPA?

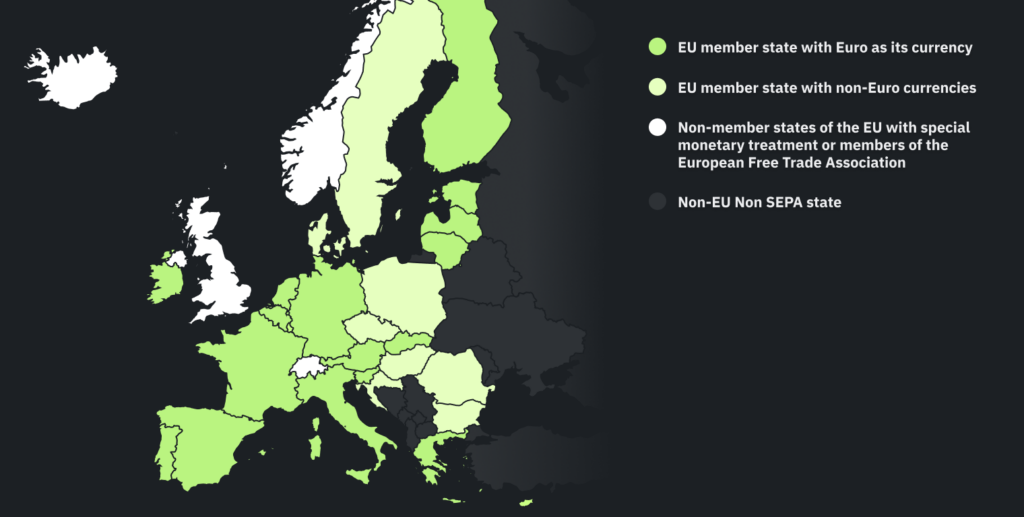

SEPA currently facilitates over 46 billion transactions per year in 36 member countries. The area in which the EU payment schemes (for euro credit transfers and direct debits) are available, spans larger than the European Union. The geographical scope of the SEPA schemes currently covers 36 countries and territories:

- 20 of these countries are from the European Union, with the euro: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, and Spain

- 7 of these countries are from the European Union, with non-euro currencies: Bulgaria, Czech Republic, Denmark, Hungary, Poland, Romania and Sweden

- 4 countries are from the European Free Trade Association (Liechtenstein, Norway, Iceland, and Switzerland)

- 4 are micro-states that have special monetary arrangements with the EU (Vatican City, San Marino, Monaco, and Andorra)

- The UK, after it left the EU in 2020. The UK was already part of the SEPA zone and still is, as SEPA membership doesn’t mandate EU membership. The majority of banking service providers still provide cross-border transfer services.

Of the 36 countries in the SEPA zone, 14 do not use the euro as their official currency. Only the payments sent and received in euros in these countries can be made as SEPA payments.

Schemes and rulebooks:

SEPA has developed several schemes to handle payments.

But, what is a payment scheme?

Imagine it as a set of rules that banks and payment providers follow when moving your money around. These rules make sure everything goes smoothly when you’re sending or receiving euros through methods like credit transfers and direct debits. So, next time you make a payment in euros, just know that it’s all thanks to these special SEPA rules!

EPC manages several payment schemes that facilitate over 46 billion transactions in the EU today:

SEPA Credit Transfer scheme

Think of it as an electronic way to move money from one bank account to another. The SCT scheme makes sending money around Europe super easy and hassle-free.

SEPA Instant Credit Transfer scheme

Welcome to the future of payments! SCT Inst is all about giving you lightning-fast transfers across Europe. Your cash is in your account in less than 10 seconds – it’s like magic!

SEPA Direct Debit Core scheme

For us regular folks, SDD means no more stressing about missing payment deadlines or getting slapped with late fees. It’s perfect for those bills that keep coming back, month after month.

SEPA Direct Debit Business-to-Business scheme

SDD B2B payments are used between companies and with tax authorities. Common use cases include repaying loans, paying taxes, or paying for large purchases.

SEPA Request-to-Pay

RTP scheme is all about letting someone ask you for money, whether you’re shopping online or dealing with bills in the real world.

SEPA One-Leg Out Instant Credit Transfer

OCT is the secret sauce that lets international money transfers happen quickly and smoothly within SEPA. It’s like a behind-the-scenes magic trick for moving your money.

These schemes created and maintained by the ECP set the rules (rulebooks) and implementation guidelines (IGs) for how member nations regulate electronic euro payment processing amongst themselves. In addition, the ECP publishes clarification papers on a case-by-case basis covering specific topics related to the schemes’ implementation.

Devengo is working hard to continue developing services for our clients via SEPA schemes, with instant transfers (SEPA-Inst scheme) being one of our fundamental focuses. Only 15% of payment transactions in Europe are instant, and almost none of them are B2B. It’s time to change that.

This is our introduction to the SEPA world. In future posts, we will continue to delve deeper into the topic and shed light on how SEPA really works. Stay tuned!