AML stands for Anti Money Laundering, a term widely used in the financial world to refer to the controls that organizations must implement to prevent money laundering. If you have ever been contacted by your bank to confirm a payment that deviated from your usual transactions (due to location, amount, type of service, etc.), you have experienced an AML process.

AML is part of the broader topic of Compliance, which includes money laundering but also other related topics like terrorism financing, fraud, cybercrime, bribery and corruption, KYC/KYB, and even transaction monitoring. There are a lot of aspects that any financial institution must monitor and control.

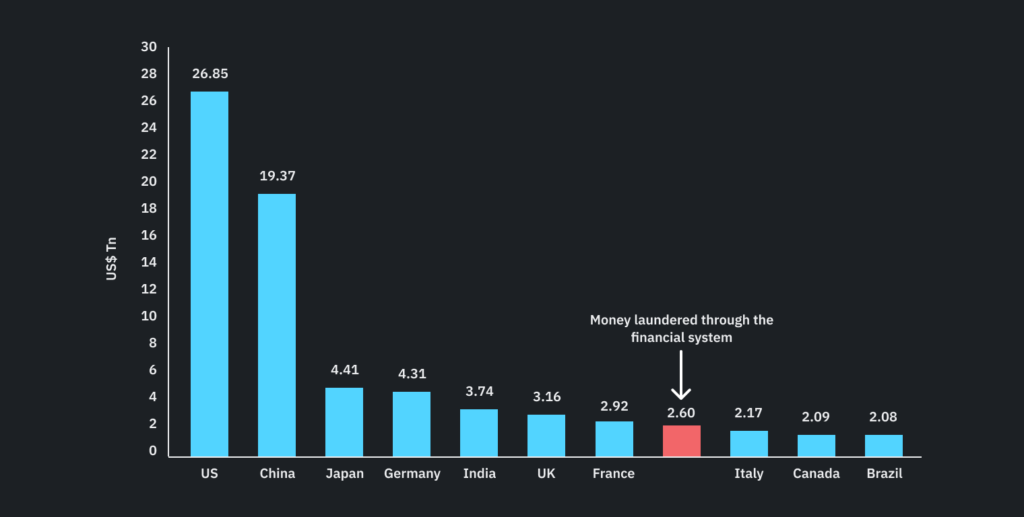

Financial crime, a lucrative industry for criminals

According to the United Nations Office on Drugs and Crime, between $800 billion and $2 trillion are laundered globally each year, with $400 billion to $450 billion stemming from drug trafficking. Similarly, the World Economic Forum asserts that between $7 billion and $23 billion come from wildlife trafficking. Regarding bribes and corruption, the United Nations estimates that $1 trillion is paid in bribes annually, and $2.6 trillion is stolen through corruption.

Looking at these numbers, it is perfectly understandable that authorities regulate and exert increasing pressure on financial institutions to enhance their controls.

Tools and Processes

There are three steps in money laundering:

- Deposit of illicit funds into the financial system

- Move those funds by using different transactions to hide the illicit origin, what is called “layering”

- And finally, use of those laundered funds in legitimate transactions

So, to fight against money laundering, the AML strategy of any payment service provider like Devengo should include understanding who their customers are but also looking for patterns in their transactions. This enables us to make informed decisions about whether a payment should proceed or if it should be reported to the relevant authorities.

Some of these tools include:

KYC / KYB

KYC (Know Your Customer) and KYB (Know Your Business) are processes through which customer (or business) information is collected to understand their activities and the source of their funds in order to assess their risk of fraud or financial crime. You’ve likely gone through a KYC process if you’ve ever opened a bank account. In these cases, the processes are usually straightforward, requiring you to provide identification and, if it’s done electronically, proof that you are indeed the rightful owner and not a victim of identity theft.

In the case of KYB, the process tends to be more extensive. This is related to the level of risk, as a business typically handles larger volumes of money compared to an individual.

In any case, it’s important to know that these processes are ongoing. At any point, a financial institution may initiate a KYC process to supplement or update the customer’s risk information.

Transaction Monitoring

Entities are required to monitor customer activity to detect suspicious behavior. This is done through various techniques, from analyzing every financial transaction to observing user interface interactions. The key point is that when suspicious activity is detected, an alert is generated for a person to review. This individual will then determine whether it constitutes as lawful activity or, alternatively, open a case for further in-depth investigation.

95% of alerts are false positives

It’s important that you get in touch with your financial provider if you anticipate a change in your activity level in order to adjust your customer profile and prevent future AML blocks. For instance, if you’re planning to increase the number of transactions significantly or if you’re going to start making higher-value transactions.

Sanctions Filtering

Sometimes, authorities choose to impose sanctions against individuals, organizations, or countries as a means of pressure to influence their decisions. Among various types of financial sanctions, the most common is the prohibition of sending or receiving money, effectively freezing their accounts.

Banks invest significant effort into keeping this list of sanctions up-to-date. Failure to comply with these obligations can result in hefty fines and a substantial loss of reputation for the bank.

As a customer, it’s crucial to be well-informed about the destination of your payments. If the bank detects that you’re sending money to a sanctioned account, they must investigate, and you may be reported to the authorities.

Instant Payments and AML

With the introduction of instant payments, new challenges have emerged in combating money laundering. Previously, with regular payments, compliance systems and teams had time to review the payments as they were sent in batches within limited time windows.

For instant payments, this validation needs to be done in real-time, making the challenge much greater. This leads to AML checks being much more conservative, resulting in a higher number of false positives or blocked payments.

Conclusion

With this article, we wanted to highlight how AML tools and processes are necessary to comply with the law, prevent criminal activities, manage potential risks, protect the reputation of companies, and facilitate international cooperation in the fight against money laundering and terrorism financing.

At Devengo, we are acutely aware that every effort is crucial in maintaining the integrity of the financial system, and we work diligently every day to prevent companies like yours from being used for illicit purposes.