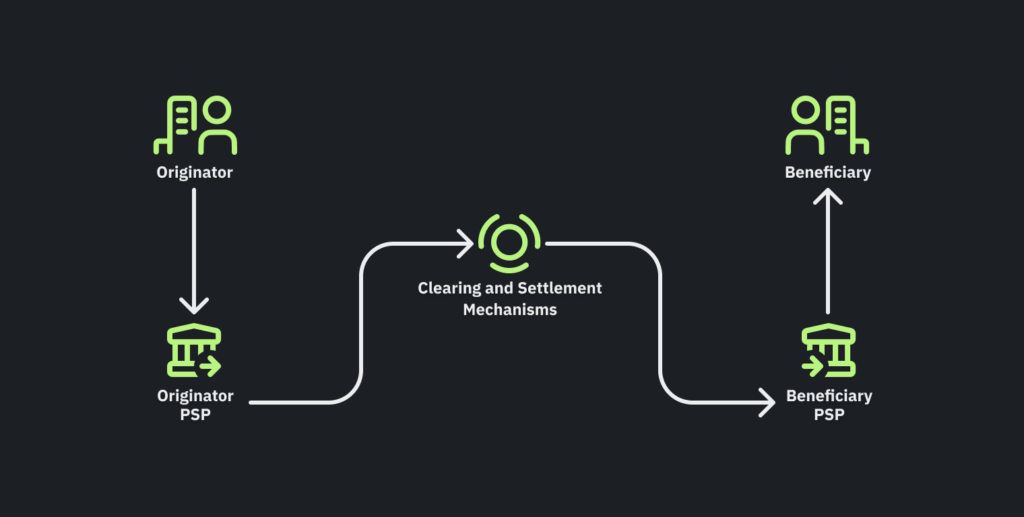

In Europe, all instant transfers are executed under a scheme known as SEPA Instant Credit Transfer, or SCT-Inst for short. As we have mentioned in other posts, like our Smart Retry System Launch, this scheme defines four parties for any credit transfer:

- The entity sending the money (e.g. a person or a company) is formally known as the Originator.

- The entity that provides the transfer service (usually a bank), officially known as the Originator PSP

- The entity that receives the credit transfer request (usually another bank), officially known as the Beneficiary PSP.

- Finally, the entity that should receive the money (again, another person or company) formally known as the Beneficiary.

The existence of these four parties and how they all interact is the reason why the SCT-Inst is usually called a “four-corner model”:

One more player plays a pivotal role: the Clearing and Settlement Mechanism or CSM. This entity is fundamentally a proxy between the participating PSPs. It provides multiple efficiency benefits, such as being able to aggregate all orders for transactions to other PSPs received from the Originator PSP during a given number of hours, as well as orders for transactions received from its other PSP customers (like the Beneficiary PSP) and intended for other PSPs, including the Originator PSP and “netting” them so only the net amount of money is moved.

We will not go into the details of these operations -you can check The Journey of a SEPA Instant Payment or my talk Instant Payments – Moving money at (almost) Light Speed if you want to know more- but from a technical perspective, the vital thing is to understand is that CSM has the responsibility of relaying XML messages between the PSPs through multiple requests done to both.

Transferring Money Instantly

With the roles of each party defined, we can put an example to make the following sections more straightforward to understand. Let’s imagine the transfer we want to do is like this:

My Spanish company, Solecito SL, wants to transfer 3.700€ euros as payment for a service invoice. The company will be the Originator.

We are banked with BBVA, a Spanish bank that will instruct the transfer on behalf of my company. BBVA will be the Originator PSP.

We are sending the money to Béatrice Mesureur, the French freelancer who provided the service. She will be the Beneficiary.

Béatrice is banked with CIC, the oldest deposit bank in France. They will be the Beneficiary PSP.

The involved CSM will be Iberpay, a CSM overseen by the Banco de España, the national central bank in Spain.

If we have a look inside the internal XML messaging passed between the parties, we will see a few key elements:

Solecito SL’s IBAN:

BBVA’s BIC:

Béatrice’s IBAN

CIC’s BIC:

The amount to transfer:

So I go into BBVA’s website, log into my company’s account, fill in the information and hit the “Confirm” button. Mission accomplished! However, 10 seconds later, I got a push notification about an error in transferring the money. Damn, aren’t transfers supposed to always work? What happened?

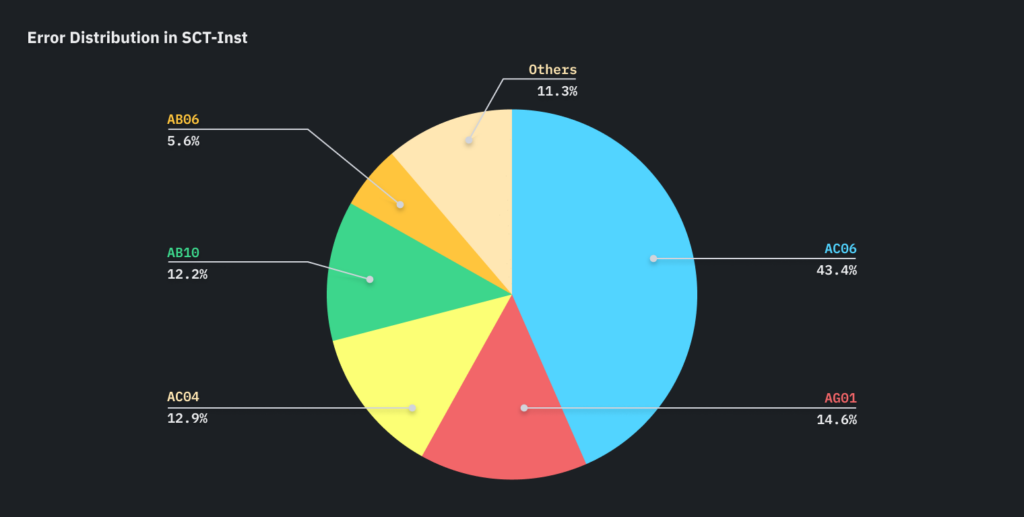

Let’s look at the five most probable causes for the error, what the official scheme’s error guide tells us, and what it actually means.

Five Most Common SCT-Inst Errors

AC06, aka Blocked account

What The EPC Guide Says

Exhaustive list of usecases: Account blocked for any financial transaction.

Root causes: Beneficiary PSP has blocked the account

Suggested action: Originator to contact the Beneficiary for alternative account/solution to pay.

What It Means

Ironically, the most common error is one with a very clear definition but a very ambiguous source. We know that Béatrice’s account is blocked for sure, but why? There are a considerable amount of potential reasons:

- CIC may have received a Court Order that mandates that the account must be blocked (the reasons for the order are innumerable, but an account seizure due to debts is not uncommon)

- The bank may have detected suspicious activity (e.g. many international payments) and proactively blocked the account to protect their customer.

- Failure to provide updated documentation (e.g. renewed national IDs) that the bank requests is another common reason for getting your account blocked.

- In any other situation, the bank may consider a perceived risk significant enough to block the account unilaterally.

Contrary to what most banks do, when an AC06 happens, Devengo will pass the error to our customer and let them know what happens exactly. From there, the customer may choose the most convenient path forward. In our example, I may contact Béatrice and give her some time to sort out the block with CIC, or she can give me another account to make the transfer.

AG01, aka Transaction Forbidden

What the EPC Guide Says

Exhaustive list of usecases: A SCT Inst transaction cannot be booked on this type of account.

Root causes: Beneficiary gave information about an account on which SCT-Inst transactions cannot be booked.

Suggested action:

- Originator to contact the Beneficiary to agree on another payment instrument

- Originator PSP to re-initiate the credit transfer as an SCT transaction if agreed earlier between the Originator and the Originator PSP.

What It Means

So what happened here? The financial industry has created a broad gamut of services and products, each with its regulatory limitations and capabilities. This error tells us that the IBAN Béatrice gave us is linked to an account or product that does not accept SCT-Inst transfers.

This prevalent error happens not only within the SCT-Inst scheme but also with other ones like Direct Debit, where some products, like savings accounts, will not allow direct “charges” on them.

As mentioned in the scheme rules, the solution here is to contact the Beneficiary and ask her for another account, or if we -she-doesn’t mind the extra time delay, we could do a regular SCT transfer. These transfers are often delivered the next business day, but depending on the time of the day the transfer is made and the day of the week, it can take +72 hours to be delivered. If we send the transfer on Friday at 4 pm, Béatrice will not get the money until Monday… or even Tuesday!

Additionally, and very crucially, regular SCT transfers do not provide the same degree of observability, so it could potentially happen that a long time after we have done the transfer, we get the money back to our account because it couldn’t be delivered to the Beneficiary.

AC04, aka Closed account

What the EPC Guide Says

Exhaustive list of usecases: The account of the Beneficiary is closed at the Beneficiary PSP.

Root causes: Beneficiary closed his account since the last time the Originator made an SCT Inst instruction to this Beneficiary.

Suggested action: Originator to contact the Beneficiary for the new account.

What It Means

This error is by far one of the clearest of the common errors. We just can’t send money to that IBAN because the account has been closed. Béatrice will have to give us another account to make the payment.

But why does this happen? Well, the most common reason is obsolete data on the Originator’s side. The IBAN used to make payments usually lives in a DB somewhere that is not always up to date. For example, an employer’s payroll system may still point to a closed bank account because an employee changed her bank and forgot to tell HR.

Sometimes, people have multiple accounts in different banks and do not have a clear vision of the money flows connected to each of them, so they may think that closing a specific account will not affect any of them just to discover that it is not the case. Be that as it may, this is a non-recoverable error, and another payment option must be found.

It’s worth noting that some countries’ data protection and privacy laws will prevent banks in those geographies from clearly stating that a bank account has been closed. Beneficiary’s PSP may return an MS03 error in these countries, basically an “Undefined/Not specified error” to prevent the disclosure of the real reason.

AB10 aka Error Instructed Agent

What the EPC Guide Says

Exhaustive list of usecases: Transaction process aborted due to an error at the CSM

Root causes: (A part of) the SCT Inst service at the CSM is unavailable.

Suggested action:

Originator to contact the Beneficiary for an alternative solution to pay

Originator PSP to suggest to the Originator to resubmit the SCT Inst transaction or to use an alternative payment instrument.

What It Means

Here, we enter the purely technical space because there are no banking reasons for these errors. To make things more complex, this error is intentionally ambiguous about what part of the chain has produced the problem. It could be an unexpected error on the CSM itself, connectivity problems between the CSM and the PSP, etc.

What does Devengo do? Well, in the beginning, we returned this error directly to our customer so it could decide -manually or automatically- to re-issue the transfer at another moment. However, trying to make our customers’ lives easier, some months ago, we launched an autonomous smart retry system that can detect these recoverable errors and automatically retry them at variable intervals, testing that the CSM has recovered and can process the transfer.

So even if it is a few hours later than expected, Béatrice will be able to get her money without any manual intervention. Automation FTW!

AB06 aka Timeout Instructed Agent

What the EPC Guide Says

Exhaustive list of usecases: Any CSM between the Originator PSP and the Beneficiary PSP has not received the initial SCT Inst Transaction within the time-out deadline defined by the SCT Inst rulebook or within a shorter timeline agreed between SCT Inst scheme participants on a bi/multilateral basis;

Root causes: Connection, processing or validation issue at any step starting from the Originator PSP, across the CSMs up to the Beneficiary PSP and back to the CSM of the Beneficiary PSP

Suggested action:

- Originator PSP to suggest to the Originator to re-issue an SCT Inst transaction at a later stage or to use another instrument (e.g., SCT)

- Originator to contact the Beneficiary for an alternative solution to pay.

What It Means

Some of the involved parties are not complying with the strict timing rules that the scheme imposes:

- The scheme defines a target maximum execution time of 10 seconds. That means that from the moment the Originator’s PSP timestamp the XML file sent to the CSM to the moment funds are available to Béatrice only 10 seconds SHOULD pass.

- It’s in the best interest of all involved parties to adhere to that target. Still, we know the road to hell is paved with good intentions for those cases where the actors cannot fit the bill, there is a hard time-out deadline of 20 seconds, after which the transfer MUST be rejected.

When these timing limits are broken, an AB06 is produced. For many developers who are used to measuring good performance in the low hundreds of milliseconds, it may be shocking that huge businesses like banks can have a problem saying yes/no to a credit transfer in 20 seconds.

Although most transfers go through without problem, the reality is that many banks have mission-critical large legacy systems that were not designed to move at internet speed and sometimes experience downtimes or performance hiccups. On top of that, more and more AML regulation is passed daily to control funds movement and sometimes it is hard to balance real-time demands with compliance requirements.

In any case, the error indicates a temporal, recoverable issue that can be solved by waiting a prudential time for the system to recover. Therefore, our smart retry system also manages this problem. Once again, Béatrice money is on the way!

And that’s it. Those are the top five errors we have consistently found after four years of operation in the SCT-Inst space and millions of transfers handled.

Do you have any questions about transfers and the errors that can happen? Do you have a horror story about bank transfers to share? Let us know on LinkedIn or Twitter, we would love to hear your story!